8 Top Payment Processors

GetElastic

OCTOBER 27, 2021

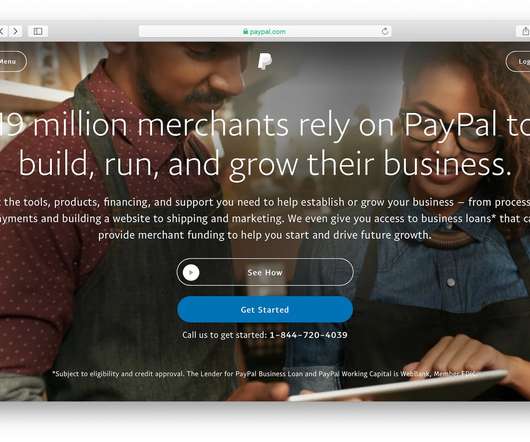

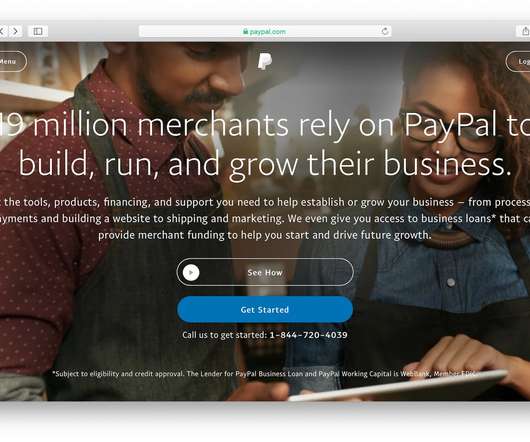

If you’re launching any sort of business you’ve thought about payment processing. With so many choices in the marketplace, the selection process can be a daunting one depending on what works best for your business. How many types of payment are accepted? What is you geographic coverage? Website: paypal.com.

Let's personalize your content