‘Cash or Card?’: Why More Financing Choices Drive Consumers’ Decisions on Which Retailers to Shop

Retail TouchPoints

MARCH 4, 2024

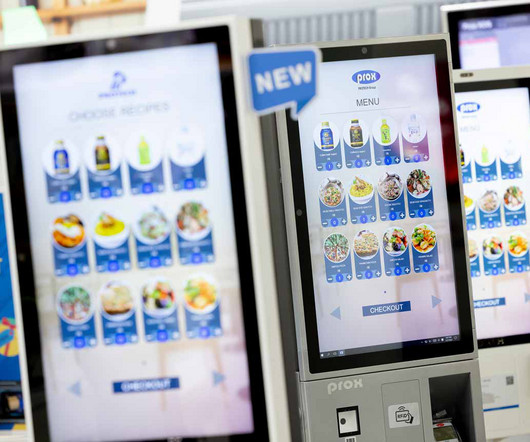

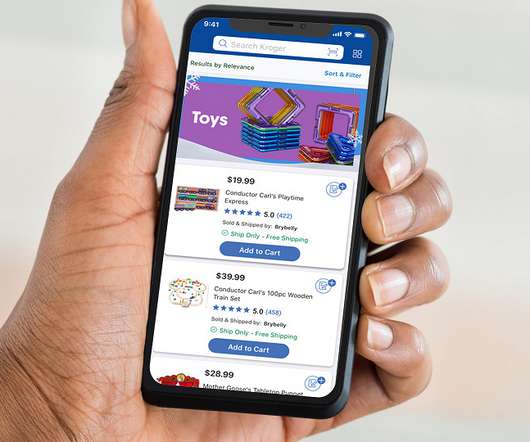

A recent study of more than 4,700 consumers from Bread Financial indicates payment choices — including retail store credit cards, bank branded credit cards and buy now, pay later (BNPL) — at checkout have become a major factor in pleasing shoppers and closing a sale. It goes without saying that great service is important.

Let's personalize your content