CFPB Announces Intention to Regulate BNPL Following Release of Consumer Impact Report

Retail TouchPoints

SEPTEMBER 17, 2022

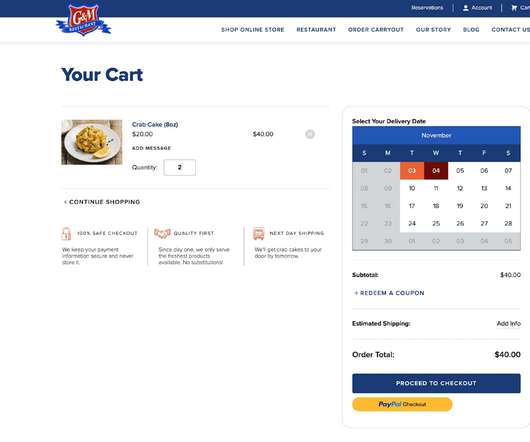

The Consumer Financial Protection Bureau (CFPB) is planning to start regulating buy now, pay later (BNPL) products. of BNPL transactions in 2019 but fell to 58.6% Buy Now, Pay Later is a rapidly growing type of loan that serves as a close substitute for credit cards,” said Rohit Chopra, Director of the CFPB in a statement.

Let's personalize your content